Financing is the main obstacle struggling with business owners when setting up a small business. Many small business owners in nearly every market have difficulties obtaining money to create their company notion to our lives. In many instances, having a mortgage isn’t the best option. Many business people choose enterprise capital capital that will help get their small business above the ground.

The Single Best Strategy To Use For Startup Venture Capital Revealed

Venture capital means credit distributed by effectively-away purchasers or purchase finance institutions to startups and small companies the investors feel have large progress possible. The service or financing from your opportunity capitalist may not continually be in the form of income some prefer to present know-how or supervision. Every time a opportunity capitalist invests in a small organization, it will always be completed in go back for home equity or simply a say in firm actions.

Generally, opportunity funds backing is applied to great-development, large-possibility firms. Here’s what you ought to know to start.

Evaluate the amount your enterprise is worth

Venture cash purchasers are going to be interested in two primary factors: Whenever they decide to commit, the need for your company, and what will their return will be. Therefore, it’s essential to know in which you take a position and what it is important to offer you.

Valuations contain complex mathematics, and a lot of project capitalists will bring in the professional appraiser that will help verify the possibility of a start up or organization. Generally, having said that, your company’s worthy of is about the following variables:

- The company’s age.

- The company’s progress amount.

- The mature control team’s encounter.

- Revenues and money circulate.

- Patents or other intellectual home.

- Number of users (if applied).

Carry out some monetary projections to indicate realistic return on your investment,

Prior to coming a endeavor capitalist. Include any obligations and value you’ve currently issued yourpromotion and sales, and enterprize model ancient earnings stability sheets and running price range and your price purchaser investment and client lifetime benefit.

Figure out how very much it is advisable to increase

Do you find yourself confident you know how considerably you will need, though

You will know you must elevate income? This multitude is essential for the company’s upcoming — the less you boost, the less you need to cede over to a enterprise capitalist. Venture capitalists will seek to get highest return of investment. If they shell out $500,000 with your organization, they should request a smaller stake in the business than whenever they spend $1 mil.

Before you tactic a enterprise capitalist, ascertain your whole essential volume by looking at the amount money you can use immediately and correctly, just how far together your online business is, and the way much control you’re eager to give up to new purchasers. Experts suggest looking for the “minimum expense amount which will get you to your following inflection level that substantially changes the chance description within your organization. This inflection position could be initially buyers, a yearly revenue multitude, or possibly a latest version of the item.” Simply how much you decide to boost will likely get more noticeable since you work through your economical projections while in the valuation method.

Venture Capital Funding

A business funds deal is generally the stepping-stone a business has to achieve the subsequent period of improvement.

Communicate with a venture budget agency

Where can you uncover project money? Many small businesses proprietors experience enterprise cash as restricted to contestants on “Shark Tank,” and aren’t certain tips on how to locate, not to mention technique, a project investment capital fund.

A reference from the economical skilled — abank and legal professional, CPA or economical specialist — is typically the simplest way to set about looking for a project investment capital opportunist. Alternately, enroll in a personal fairness seminar or market occurrence to begin with marketing. Many ventures from project capitalists come from setting up trust and private partnerships with time. Treat each assembly such as an prospect and carry a finished pitch with you to every 1.

The way to prepare for and pitch the opportunity capitalist

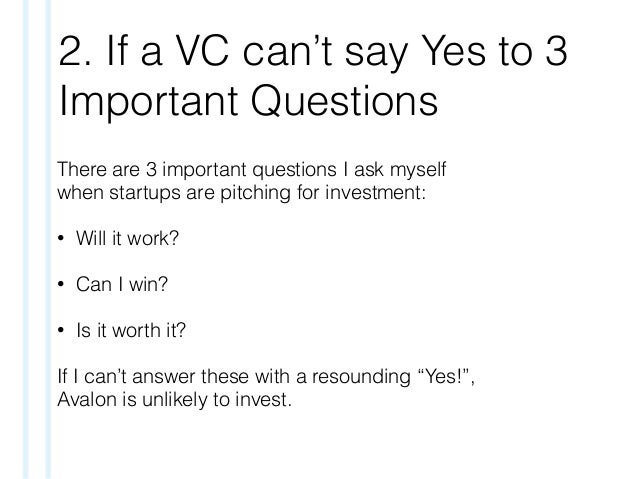

Before you talk to a endeavor capitalist, you should definitely ready yourself. Some endeavor capitalists get several thousand requests for financial aid year after year, so you must place yourself to determine your company’s business structure and why it is distinctive and deserving of investment decision.

The true secret within your delivery will be to keep to the facts and continue your pitch brief. Statistics reveal that a venture capitalist spends usually 3 minutes or so and 44 mere seconds analyzing a pitch deck — so take care of your original pitch as the first step inside a for a longer period courtship.

Based on one specialist, “You’re actually trying to fresh paint the important perception but additionally give so much info or just as much traction as possible to ensure that furthermore they view the perspective, but they can are convinced it might be built.” You can discuss your quick-time period and long term visions, the challenge you are dealing with for your personal upcoming consumers, and why the current market is prepared for your strategy.

Simply what does a endeavor capitalist deal involve?

A project funds package is generally the stepping stone an online business has to reach the subsequent step of development. Analysis by Harvard Business Review demonstrates that “more than 80Percent of the funds spent by venture capitalists explores setting up the infrastructure required to increase the business—in expenditure investments producing and marketing, and revenue) plus the stabilize page (presenting predetermined property and performing cash).”

The way the option is organized may vary marginally dependant upon the program, the requirements this business as well as the project capitalist firm’s calls for. The principle is the same throughout all project investment capital deals, though generally speaking: The buyers would like to protect their investment if a little something goes completely wrong, and in addition boost their reward when the corporation turns out to be prosperous.

Such as, a venture capitalist will shell out $500,000 to acquire a 20Percent management location. Inside the conditions they are going to have “downside security,” a security internet that defends the investment if one thing goes wrong. That could mean they get initially state they the property and systems, or that the enterprise capitalist might have voting legal rights through key selections. Prior to signing.

How much acquisition in case you be inclined to stop to the venture capitalist?

The reply to this question is dependent upon some factors:

8 Important Methods To Venture Capital Funding

Your personal ownership structure. Sole proprietors seeking out money possess a fairly uncomplicated offer. However, in case you have a workforce of founders, and also specialised professionals (designers, software program programmers, fashion designers), you may want to provide equity to improve morale and maintain your crew motivated. Subsequently, there will probably be less to provide a opportunity capitalist with regards a chance to increase backing.

Your personal ownership structure. Sole proprietors seeking out money possess a fairly uncomplicated offer. However, in case you have a workforce of founders, and also specialised professionals (designers, software program programmers, fashion designers), you may want to provide equity to improve morale and maintain your crew motivated. Subsequently, there will probably be less to provide a opportunity capitalist with regards a chance to increase backing.

How many rounds of funds you will require. Venture investment capital financing is frequently merely the initial round of investment decision in your company. Down the road, you could tactic a unique financial institution or have to blend with a competitor. Give away an excessive amount of on the primary fundraising events spherical, and you’ll have a lesser amount of leverage for development down the road.

Experts say a great standard is to actually maintain at least 25Per cent ownership within your company. Which means the other 75Percent is up for splitting amid project capitalists, other associates with your founding organization.