MBA Mondays are lower back after a one week hiatus. Today we are going to talk about convertible car debt. Convertible debts can certainly be identified as convertible car personal loans or convertible information. For those purpose of this submit, these about three terms will be exchangeable.

The secret of Startup Venture Capital

Convertible debts happens when a firm borrows income from a venture capitalist or a small grouping of traders and the purpose of your shareholders plus the company is to transform your debt to home equity at some later time frame. Typically just how the debt are going to be changed into home equity is given back then the money is produced. Sometimes there exists settlement such as a deduction or even a warrant. Other times there exists not. Sometimes there exists a limit for the valuation from which your debt will transform. Other times you will find not.

Greatest 50 Tips For Venture Capital VC funding Malaysia

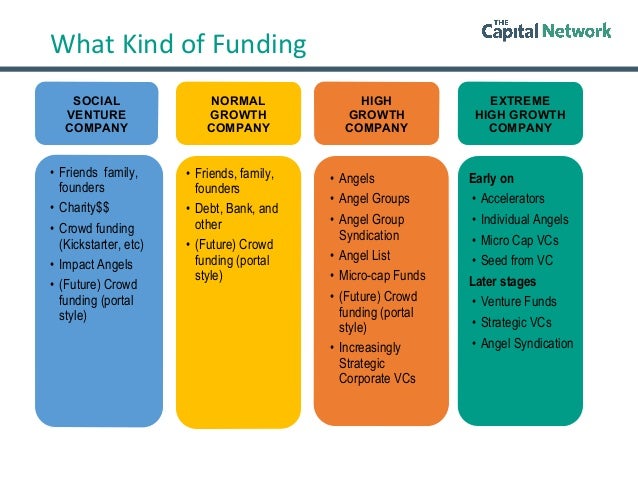

There are a number of main reasons why the brokers and/or the company would rather situation credit card debt in lieu of equity and turn your debt to collateral at a later date. For that firm, the reason why are clearer. It would weaken less by issuing personal debt and converting it down the road when the firm believes that its value will likely be value much more at a later date. Additionally, it is genuine that the deal expenditures, VC funding Malaysia mostly appropriate costs, are often a smaller amount when issuing debt or home equity.

For purchasers, the inclination for debt as opposed to collateral is less clear. Sometimes investors are really willing to have the option to get a firm that they can put their dollars in to a convertible car notice and permit the next spherical shareholders set up the price tag. They think that whenever they was adamant on setting a value now, the organization would not take their income. Sometimes purchasers believe that the compensation, through a merit or simply a price cut, is enough worthwhile so it offsets the value of getting credit card debt vs equity. Finally, VC funding Malaysia financial debt is elderly to collateral within a liquidation so there is certainly some more security in going for a financial debt posture in the organization vs . an value posture. For ahead of time phase startups, even so, this is simply not primarily beneficial. In case a start-up breaks down, there is certainly typically little if any liquidation price.

friends and family rounds, which we outlined previously in this particular collection, will often be carried out by convertible car financial debt. It seems sensible that relatives and buddies would not need to initiate a hardball negotiation using a creator and would rather enable the selling price dialogue happen when specialist buyers enter in the scenario.

friends and family rounds, which we outlined previously in this particular collection, will often be carried out by convertible car financial debt. It seems sensible that relatives and buddies would not need to initiate a hardball negotiation using a creator and would rather enable the selling price dialogue happen when specialist buyers enter in the scenario.

The common varieties of settlement for creating a convertible loan are justifies or maybe a low cost.

Warrants are one more type of an alternative. They are really very similar to options. In the usual convertible be aware, the Warrant are going to be a choice for whatever security comes over the following around. The Warrant is most often stated when it comes to “warrant insurance percent.” For instance “20Percent warrant insurance” indicates you have the actual size of the convertible notice, say $1mm, grow it by 20Percent, which will get anyone to $200,000, as well as Warrant is going to be for $200,000 of added securities over the following rounded. Simply to comprehensive this model, let’s say the following rounded is good for $4mm. Than the complete measurements of another round are going to be $5.2mm ($4mm of new cash additionally $1mm in the convertible note and also a Warrant for yet another $200k). The full value of the convertible bank loan is $1.2mm of dilution for the after that circular value for $1mm of money.

The Ugly Fact About Venture Capital Funding

A reduction is much easier to fully understand but typically more complicated to carry out. A price reduction will be stated in terms of a percentage. The most prevalent savings are 20% and 25Per cent. The price cut is the number of reducing of price the convertible car loan owners is certain to get when they convert within the next spherical. Let’s utilize the exact same example of this as right before and utilize a 20Per cent lower price. The firm brought up $4mm of new hard cash as well as the convertible car mortgage stands is certain to get $1.25mm of fairness within the circular for changing their $1mm mortgage loan ($1mm split by .8 is equal to $1.25mm). Said yet another way $1mm is actually a 20% price cut to $1.25mm.

Convertible notes also typically have some cap in the valuation they are able to switch at. That cap is from the actual valuation (not typical) to your multiple from the present valuation. Recently our company is starting to see uncapped convertible car information. These notes have zero cover on the valuation they will change at.

Startups ordinarily contemplate rearing budget by using convertible car personal debt in the beginning from the lifetime of a new venture. They will relocate fast, retain exchange prices lower, and they are often working with a syndicate of angel brokers in fact it is simpler to get the around finished with a convertible notice when compared with a seed or sequence A around. While they are all excellent reasons to consider convertible personal debt, I am not really huge supporter than it at this time inside a company’s living. In my opinion it truly is fantastic perform to create value of the value early on and commence the procedure of improving it round immediately after circular soon after rounded. I additionally usually do not choose to invest in or individual convertible debt personally. I want to know how much of a corporation I’ve bought and I do not like getting fairness danger and becoming credit debt profits.

What are the types of venture capital?

The three principal types of venture capital are early stage financing, expansion financing and acquisition/buyout financing.

However, later on within a company’s existence convertible debts produce a lots of perception. Not too long ago, startup venture capital we got a investment portfolio business which has been thinking about an exit in a year to 2 yrs and required one final circular of financing for getting there. They journeyed out and talked to VCs and figured out just how much dilution they would bring to obtain a $7mm to $10mm boost. Certainly they attended Silicon Valley Bank and spoke with the endeavor financial debt class. They increased similar to $7.5mm of enterprise credit card debt, granted SVB some Warrants as settlement for making the financing, and made the firm for yet another year or so, distributed it and managed superior in the end as they averted the dilution from the final spherical, all things considered. This is an instance of where by convertible credit card debt is very beneficial in the funding approach of your start up.

My suppose is we will see the application of convertible debt, specifically with no payment with no cover on valuation, wane since the present loans rare metal buzz fizzles out. It will continue to be a very important but less frequent form of very early stage new venture finance and will also be particularly useful for such things as family and friends rounds where by all gatherings need to defer the price tag negotiation. But I assume that we will see it used more commonly as companies expand and build modern-day financing wants. It is actually a fantastic composition when the salary for making the loan is balanced and realistic so when the debt or collateral tradeoff is wonderful for both lender and client.