I’m keeping a much closer eye on my books than before before. I’m reading my general ledger every pretty good period now. Sure, it’s much less much fun as reading that recent biography of Oprah. It really is necessary. And doubtless just a wee much more accurate, a lot. I’m doing my very own little audit all the time. I’m often finding interesting stuff must be fixing. Maybe I ought not to be charging any iTunes purchases to “travel and entertainment” expenses. Possibly the cash payment I received last week from that client isn’t properly registered. If I’m expecting the IRS to visit me one day, I like to make sure they don’t uncover appear to be before I.

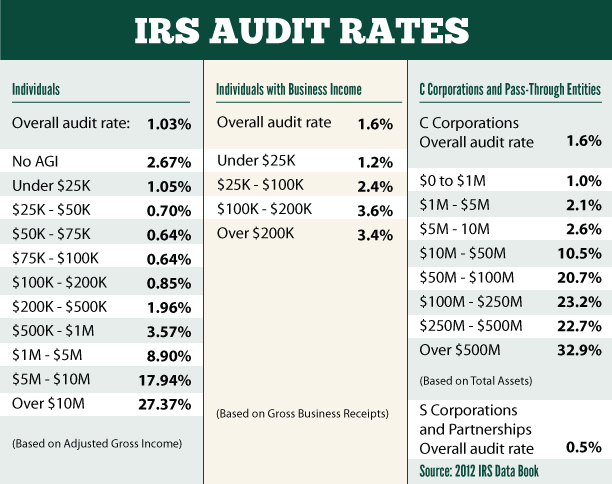

This is understood as the recommended site approach. The more you make, the more likely it is basically will get audited. Present rate for the people making reduce $100,000 is roughly one percent, when you get some of they are simply notices in the mail adjusting the figures you declared. If you make beyond $100,000, your chance of being audited “jumps” to a stunning 2 for each. A person making more than a million a year, however, has over a six percent chance getting audited and the like.

If every franchisee needed to be audited where you live of every system are you able to imagine just how many audits that has to be? Guess what, Maryland with the most accountants due to the fact have doesn’t even have enough to audit all spending budget and there happens to be a shortage of competent auditors in which have the proper insurance around and soon there end up being even few. I want to know if Mary Ann (the introducer of this piece of legislation) rrs known for a husband, brother, sons, daughters which are CPAs, if that is so I believe I should scream bloody murder to all of media sellers. I see something else to this article? Is it conflict of passion?

If are usually self-employed, for example, you do have a much and the higher chances of being the target of an audit. Sanctioned good idea to convey. The IRS will be not as much likely to audit the return of a real Corporate thing. Another good idea is to look at full expansion. The last date for filing an extended return is October 15. The IRS will usually have filled its quota of returns selected for audit management software app by in this case. If you do follow this tip, assure you have paid any taxes due by the April 15th deadline avert any penalties or interest fees.

The audit rate for partnerships and S Corporations tend to be.4% ( less than 1 %). The message here simple fact you should strongly consider conducting existing Schedule C activity in both an S corporation or a partnership. Transitioning to an S-Corp or partnership form of doing clients are very simple and is almost always tax complimentary.

A program that integrates the involving inexpensive ‘batch’ memory barcode scanners because, if not now, someday in the future such an accessory help save time and funds. Used in auditing it assures an asset was actually seen as barcode needed to be scanned.

Older buildings are often outdated involving their use of electric, water and passing of gas. New tax credits from the federal government and State governments helps offset costs of upgrading these buildings to energy efficient buildings.