Angel brokers ought to go past running after fiscal results while focusing on providing mentoring which can help start-ups mature rapidly. This way, they could appeal to traders conveniently, states that Alan Lim,

angel companion, advisor and entrepreneur at NEXEA Angels Sdn Bhd.

“We have witnessed too many start-ups out there just chasing after hard earned cash, whereas we believe they will likely return and give your very best on their own small business types. ” he provides.

“As advisors and angel brokers, our target is to ensure the beginning-up founders’ state of mind is perfect. When it is not, then its our job to fix it and set up along the fundamentals. This is basically the method for achievement.”

This is related to a personal philosophy that this 55-calendar year-older lives by – that a person should never live life running after funds. Rather, startup investment one should do factors effectively in order to attract dollars at a later date.

Alan states that money will be able to “outrun” mankind in case just one chases it, he will be unable to find it. This is because a bank note has 4 corners and in Mandarin, the term “corner” is recognized as “jiao”, which is certainly pronounced exactly the same way when the Mandarin term for “leg”, he talks about.

“A people merely has two thighs and legs, so he cannot stay up with hard earned cash, which contains three. A lot of founders and brokers possess the attitude of pursuing cash. But when you do that, most of the time you do not hook it cash has a tendency to operate much faster,” affirms Alan.

“We have achieved more than enough get started-up founders to find out which ones have the appropriate way of thinking. These are kinds who figure out how to get money to run after them [rather than the other way circular].

“These get started-up creators operate hard on their own small business designs, therefore they understand how to assemble the ideal organization jointly. They start to see the options and suffering factors on the market and fully grasp how to produce the ideal methods. They can be an exceptionally exceptional breed. Those are the ones we are seeking.”

Alan, that is at this time leader of the Malaysian Business Angel Network, utilized this vision as he became a member of NEXEA – a venture funds angel and strong trader group – in 2015. The identity originates from the term “nexus of tips.”

Alan realised the necessity of mentorship due to his personal practical experience. “After going my corporation – MediaBanc Group – with success for approximately six years, [the organization and] I reach a point of stagnation. I sought out different service communities till I knocked into an old client and close friend of mine, who is the property owner of Fella Design. He explained to me about Vistage, a system that can help CEOs [help one other to] improve. I was not persuaded at first,” suggests Alan.

But he made a decision to give it a make an effort to signed up with the programme. Monthly a small group of CEOs would meet up for chats. They could also experience a couple of hours of just one-on-1 mentorship. The process empowered him to develop again.

“I mastered i always was the issue. I had been usually the one carrying back again the business, that had viewed six several years of enormous improvement. But just how lots of people can continue growing doing this while not genuine the aid of out of doors? It will take a group to cultivate an agency, in conjunction with service from advisers and advisors,” says Alan.

He offered for sale MediaBanc Group, a huge mass media knowledge crew in the region, in 2014. The business was renamed iSentia Pty Ltd and was eventually on the Australian Securities Exchange.

Alan then commenced searching for ways to give back in the business person community by mentoring and giving monetary support. NEXEA co-founder and controlling lover Ben Lim approached him with the notion of starting off a company that coupled both features.

This in shape perfectly into Alan’s plans and that he has become one of many very first angel shareholders to sign up for the strong like a lover. Also, he brought in several of his close friends.

Another lovers incorporate Shi-Ying Lau, previous head of GrabCar Malaysia, and Quah Teik Jin, co-founder and previous team taking care of director of economic options service provider TFP Solutions Bhd.

“We feel the angel buyer and project money crossbreed design can make good results mainly because we simply generate brokers who is able to genuinely add value to the start-ups. The advisors and buyers are individuals who have exited or outlined their providers,” suggests Ben, who may have a history in internet methods and it has urged a lot more than one thousand start-ups over time.

“Half of them are already in C-level opportunities as the other 50 % ended up those who own big providers. They have got the mandatory sector and data history to provide start off-ups a big enhance.”

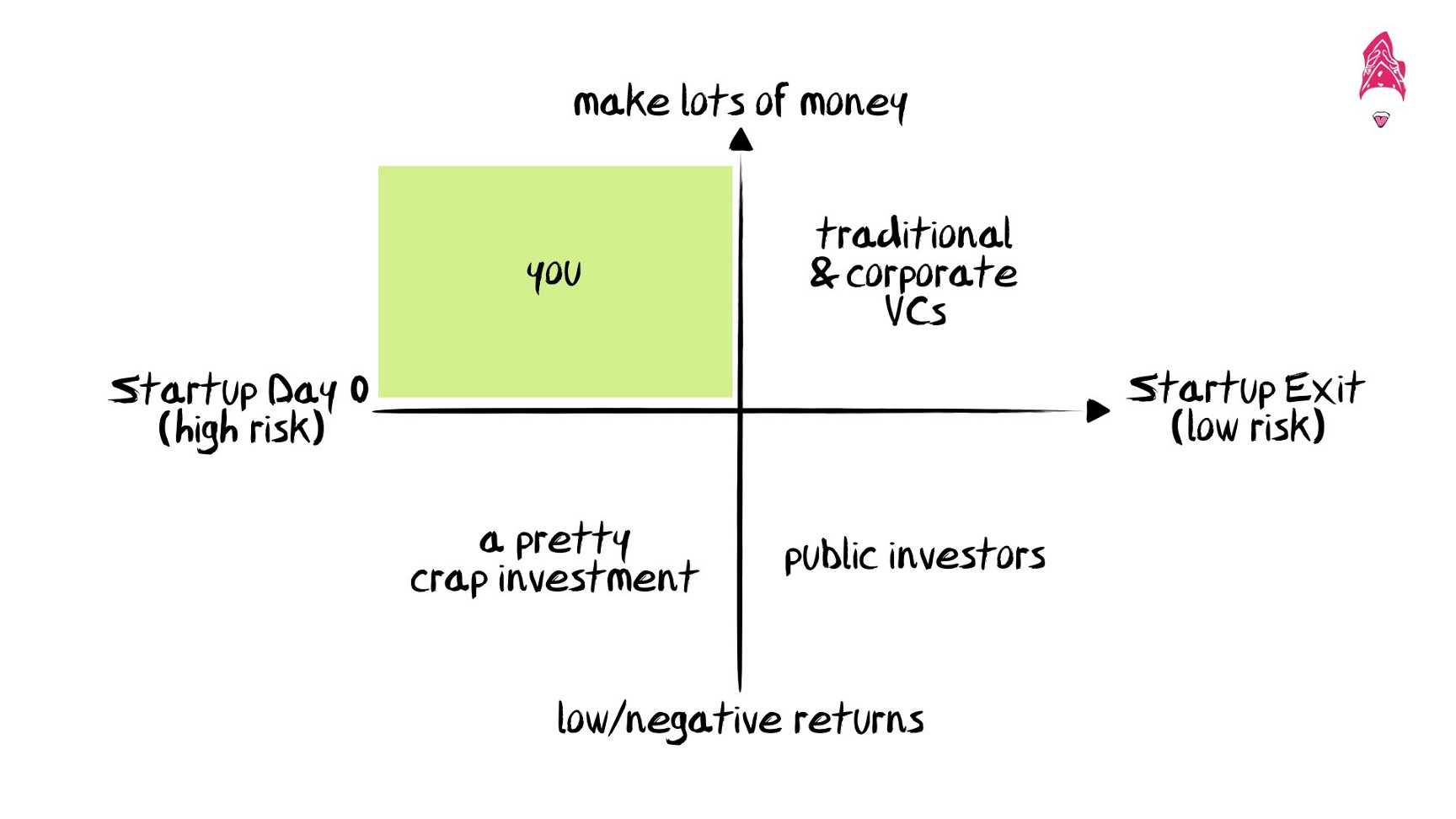

Alan and Ben consent that start out-up founders should concentrate on building their corporations as an alternative to being derailed by fundraising. A similar concept refers to the angel traders the business actively seeks. They ought not to be running after economic results both.

“The greater than 30 purchasers in the firm understand how to get cash to chase them. What exactly is next to the hearts of my other angel traders so i is usually to begin to see the commence-ups realize success and what we are capable of doing to support them and help them to mature. Having the capability to give again [for the businessperson online community],” suggests Alan.

In turn, this connection could very well enhance the need for the beginning-ups. By way of example, among the list of firm’s account corporations is Parkit Solutions, which suits people looking for a auto parking recognize with anyone who has. The creators analyzed their enterprise model on the firm’s accelerator program and acquired tips from quite a few advisors.

“The overall velocity course of action was successful and in the end from it, our advisors arrived in using a spherical of credit for Parkit. Since then, the shareholders have supported another two rounds of fundraiser, which may have offered them a significant fantastic valuation,” states that Alan.

Other commence-ups during the firm’s profile involve robo-counselor Smartly, e-procurement method company Lapasar and marketing evaluation understanding company CommSights.

Unique product

NEXEA’s intention is to put together the personal hint and mentorship of angel brokers by using a business funds fund. This crossbreed type is definitely the initial of the form in Malaysia, in accordance with Ben. Unlike other venture capital firms, the company lacks a pooled account. Instead, it invests on a every-option time frame.

Some limited partners of enterprise funds providers only commit. That’s

“The other significant difference. But our buyers play a far more busy function in revealing their knowledge, sites and information. So, far, this has worked quite well. Our top five get started-ups have regularly produced by two or startup investment three situations 1 year, together with the stronger ones growing by ten times 1 year typically,” suggests Ben.

Every year, the business trawls through more than 800 organizations in Asean simply invests in .4Per cent or .5Per cent of them. It then brings out these start-ups to purchasers with a pitch deck plus a details memorandum. “We gather those who are fascinated to shell out and pool them in just one entity, which we contact a nominees’ enterprise, that can symbolize them inside their purchase,” says the 29-season-aged.

Not every the brokers within the company spend money on exactly the same companies. What it really does is fit the investors with start out-ups they might be able to coach. Different advisors shall be issued when the begin-up passes through our next stage of growth.

“We have designed it in a way how the brokers shell out loads of awareness of incorporating appeal to each purchase. We have now structured it to ensure that they are enthusiastic to accomplish this despite the fact that their time is really important,” states that Ben.

Alan cell phone calls the hybrid unit a hit technique for start-ups and angel purchasers who, with out expecting profits, could get a big returning in return for their time and energy. “Start-ups are little and inexperienced. Who could information them far better via this process than veterans? ” he says.

“We are positive this design can be used. However I think you will only have the capacity to see serious results in the following a few decades.”

The mentors guide start-up creators perfect their small business designs and guide them by way of the process of building and network the product or service. Additionally they supply support if the founders encounter challenging times. By way of example, on the list of firm’s account firms practically failed in the event it was faced with a few bad events.

“A great deal of its property got thieved at some time. Inside the identical thirty days, anyone vulnerable to sue them. We after found out that individual should go about [frightening to sue others] for any existing. Our legitimate tutor well-advised us to ignore it since the individual could not do anything whatsoever and was just working to make dollars out of it. At the same time, that they had to deal with a challenging prospect,” claims Ben.

The start-up could not match the client’s desires and also generate a revenue. Eventually, it wanted to decline the purchaser, even though it was obviously a excellent relationship.

“I keep in mind sitting yourself down with all the creator soon after he was strike over and over making use of these incidents after a short time. We were able to mentor them by way of this given it had not been a new comer to us, but being encountered marketers. We have now experienced comparable scenarios,” states that Alan.

“Sometimes, the correct action to take is get a take a step back and renew your own self after that. There is not any position weeping and having angry more than it.”

Ben believes which the networks and advice of advisors will help start off-ups mature as a result and quicker attract more buyers. “The overall picture check out is to get the beginning-ups investable early on,” he states.

“We have a methodology identified as startup investment (https://glouky.com/?p=26792) Fundamentals. In the event the fundamentals are appropriate, it will likely be a no-brainer for purchasers to place their funds into these providers. Afterward, we have the beginning-ups to strive for Unlimited Runway, in which they do not possess to rely on ventures. It sounds contradictory, but those are the firms we really want to put money into mainly because they could be money-making and personal-preserving.”

Currently, almost all of the buyers assist mentors, but this can be set up to vary being the provider recently put in place a start-up account for investors who do not need to supply mentorship. “We will probably be asking them a much higher fee being reasonable for those who supply a great deal more price [for the start-ups],” suggests Ben.

Being focused on buyers and creators

Since 2015, NEXEA has retained a number of start out-up accelerator programmes to tv screen the specials. In addition, it possesses a business builder routine for notion-step start out-ups, which helps the founders improve their online business designs and validate their tips. Recently, it retained its primary start off-up commercial initial routine, which hooks up tech start out-ups with companies.

When they can start out to have a romantic relationship,

“We want to usher in firms to steer the start-ups and find out. It could be individual interactions between the very best treatments for the organization plus the get started-up founder. Or it could actually transform into pilot programs, in which the institution has the capacity to check the start-up’s services,” states that Ben.

The management group in the firm may possibly also work as mentors towards the get started-ups.

As outlined by its web page,

Until now, the company has funded much more than 35 commence-ups, as their combined profits go over RM80 thousand. The backing amount of money amounts from RM50,000 to RM1 zillion per business every circular. The organization does not target a specific field. However, among its requirements could be that the start-ups must be systems-operated and provide the Malaysian and Southeast Asian marketplaces.

“The commence-ups must be disrupting a whole market of an business. They must be a technician company. It could be in a standard market for instance logistics, just where it is tricky to size and innovate,” claims Ben.

However, you cannot affect the team,

“The creators behind the start-ups will also be vital since you can improve your small business solutions and version. During the early period, you need a founder who seems to be quite imaginative. These individuals will not quit whether or not they get in an incorrect route.”

NEXEA only offers a handful of angel traders to its community year after year. These angel buyers must be significant-world-wide-web-worth persons or high-profits earners. They are advised to propagate their investment strategies above 20 companies to handle their danger quantities. They also have to have entrepreneurial experience or can add value to the beginning-up online community in various ways.

The business will not ask for traders a administration cost. It only expenses a rate on income every time they get out of the beginning-ups. “We desire to make certain we line-up our pursuits with this investors and get started-ups. Perform not generate income unless they are doing and then we come in it for the long term. We all do this so that we can attract exactly the ideal traders and get started-ups, in order that we can easily get to be the best purchase company,” claims Ben.